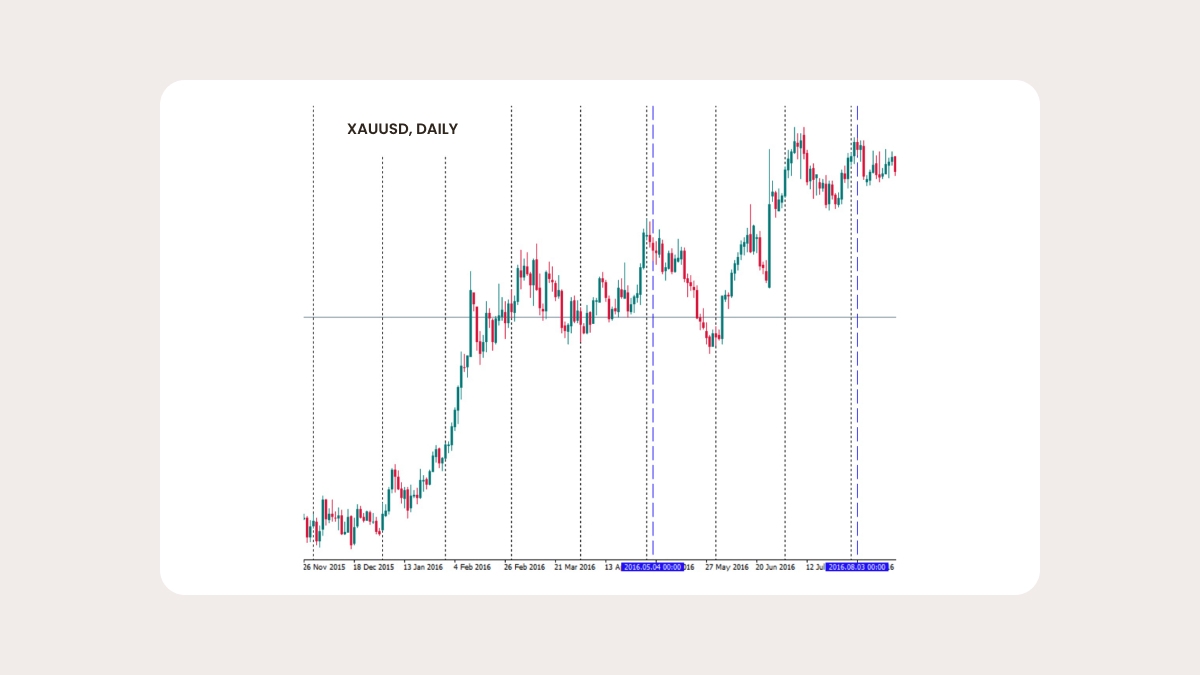

Gold trading is not an easy topic, as the yellow metal does not move the same way as other commodities or currency pairs on the forex market. However, there are some well-known strategies that can help you succeed in gold trading.

News trading

Besides the usual statistics, gold is affected by political and economic factors, global disasters, terrorist attacks, and crises. This is because gold has tight connections with different equity and raw materials markets.

The dynamics of gold prices do not follow the usual logic. Trading on the news can only be successful after major releases or events. It is highly recommended that you do not open positions immediately after the event, because you do not know where the price will go.