1. Summary

- Current Price: 1.3319

- Resistance Zones: 1.3300–1.3600

- Support Levels: 1.2500

GBPUSD is testing a major resistance cluster between 1.33 and 1.36. A clean break above 1.36 could unleash further bullish momentum. However, failure to clear this zone could trigger a pullback toward the 1.25 support, especially if BoE dovishness intensifies or U.S. data surprises the upside.

Momentum Bias: Bullish above 1.33, but needs confirmation above 1.36 to sustain breakout.

2. Fundamental Factors Affecting the Currency Pair

UK Outlook

- Q1 2025 GDP: Grew 0.7%, beating expectations and signaling economic resilience.

- Inflation Risks: CPI projected to rise to 3.5% in Q3, driven by utility and tax hikes, complicating the BoE's path.

- Monetary Policy: The base rate is now 4.25% after four cuts in mid-2024. BoE policymakers are divided, with some (e.g., Catherine Mann) warning against further easing due to sticky inflation.

U.S. Outlook

- April PPI: Fell 0.5% m/m, indicating waning inflation pressure and raising the likelihood of Fed rate cuts later in 2025.

- The dollar weakened slightly on dovish Fed bets, lifting GBPUSD.

3. Key Takeaway for Traders

The pair's next move hinges on UK inflation data, BoE forward guidance, and continued U.S. disinflation.

Upcoming Catalysts:

- UK CPI & labor market reports

- BoE speeches and voting splits

- U.S. retail sales and FOMC minutes

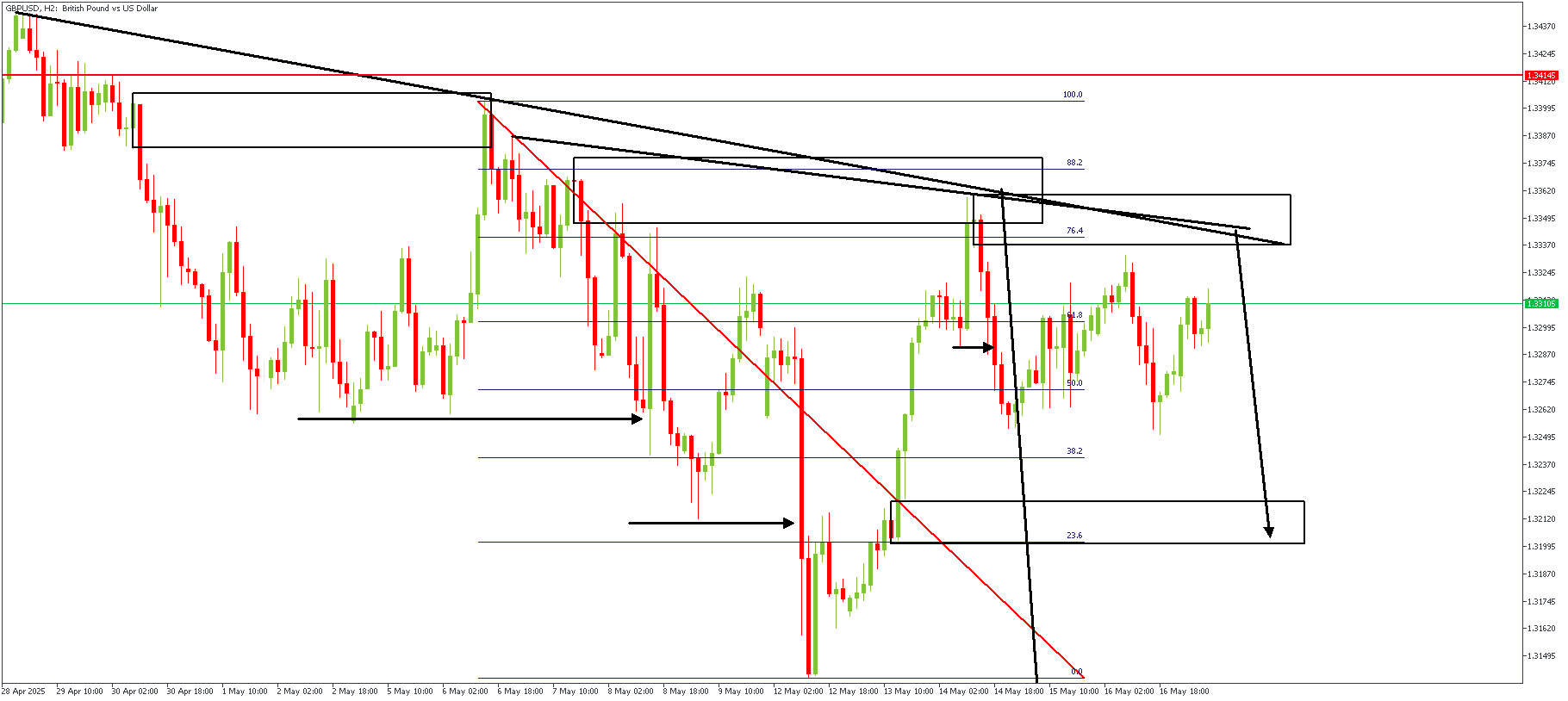

GBPUSD – H2 Timeframe

Following the rejection from the trendline resistance at the previous high on the 2-hour timeframe chart of GBPUSD, we see price sweep the external liquidity from the low, thus breaking structure. Now, seeing the retracement reach the supply zone of that bearish impulse means price could seek to continue bearish. This bearish sentiment is supported by other confluences such as the double resistance trendlines, 76% Fibonacci retracement level, rally-base-drop supply, and the internal shift in the market structure.

Analyst's Expectations:

Direction: Bearish

Target- 1.32133

Invalidation- 1.33768

CONCLUSION

You can access more trade ideas and prompt market updates on the Telegram channel.