Fundamental Analysis

USD strengthens on trade truce and CPI anticipation

The U.S. dollar gained strong momentum this Monday, driven by relief in markets after the 90-day trade truce between the U.S. 🇺🇸 and China 🇨🇳. The mutual tariff reduction—Washington down to 30% and Beijing to 10%—helped ease concerns over a potential global slowdown and reignited demand for USD-denominated assets. The U.S. Dollar Index (USDX) rose over 1.20% during the European session, while equities rallied and gold dropped more than 3%. This risk-on shift reflects renewed confidence in U.S. macroeconomic stability, especially as both nations confirmed they will continue negotiations and do not seek a full decoupling.

However, traders’ attention is now shifting to Tuesday’s key event: the April Consumer Price Index (CPI). Expectations point to a year-over-year reading of 2.4%, unchanged from March. Analysts warn that Trump’s tariff policies could reignite inflationary pressures in the coming months. If this trend materializes, the Fed might reconsider its pace of rate cuts, further supporting the USD. For forex traders, pairs like EURUSD and GBPUSD could remain under downward pressure if the inflation data exceeds expectations and strengthens the greenback.

Technical Analysis

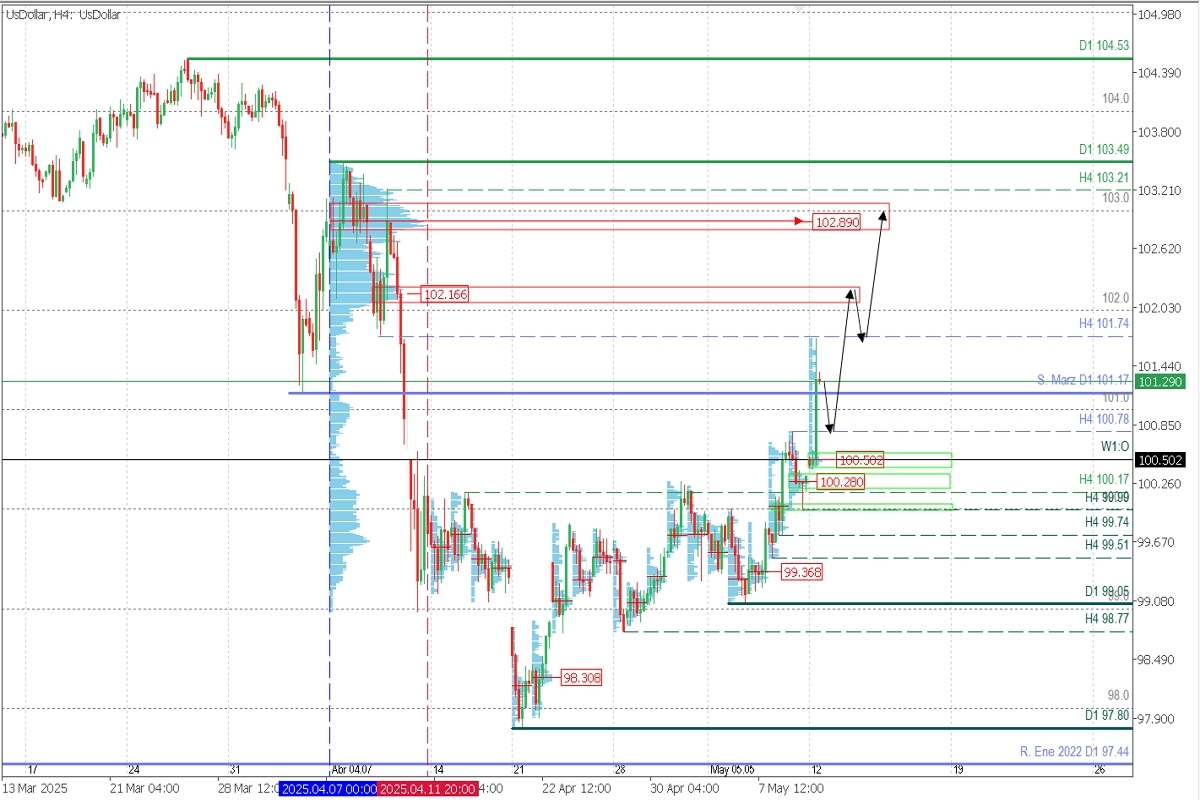

U.S. Dollar Index (USDX) | H4

Supply zones (Sell): 101.74, 102.16, 102.89

Demand zones (Buy): 100.28, 100.50, 100.00

Monday's headlines triggered a strong intraday bullish reversal in USD, with a 1.30% gain in the European morning. After reaching 101.74, price pulled back to correct the low-volume inefficiency caused by the sharp rally, potentially seeking liquidity near 101.00, 100.78, or even 100.50

Buyers are expected to return above 100.00 for a move toward the next weekly supply areas around 102.00, 102.16, and 102.89. The key intraday support for this new bullish trend is at 100.00; as long as this level holds, further USD strength is expected.

→ Consider buying USDJPY, USDCHF, USDCAD

→ Consider selling GBPUSD, AUDUSD, NZDUSD, XAUUSD

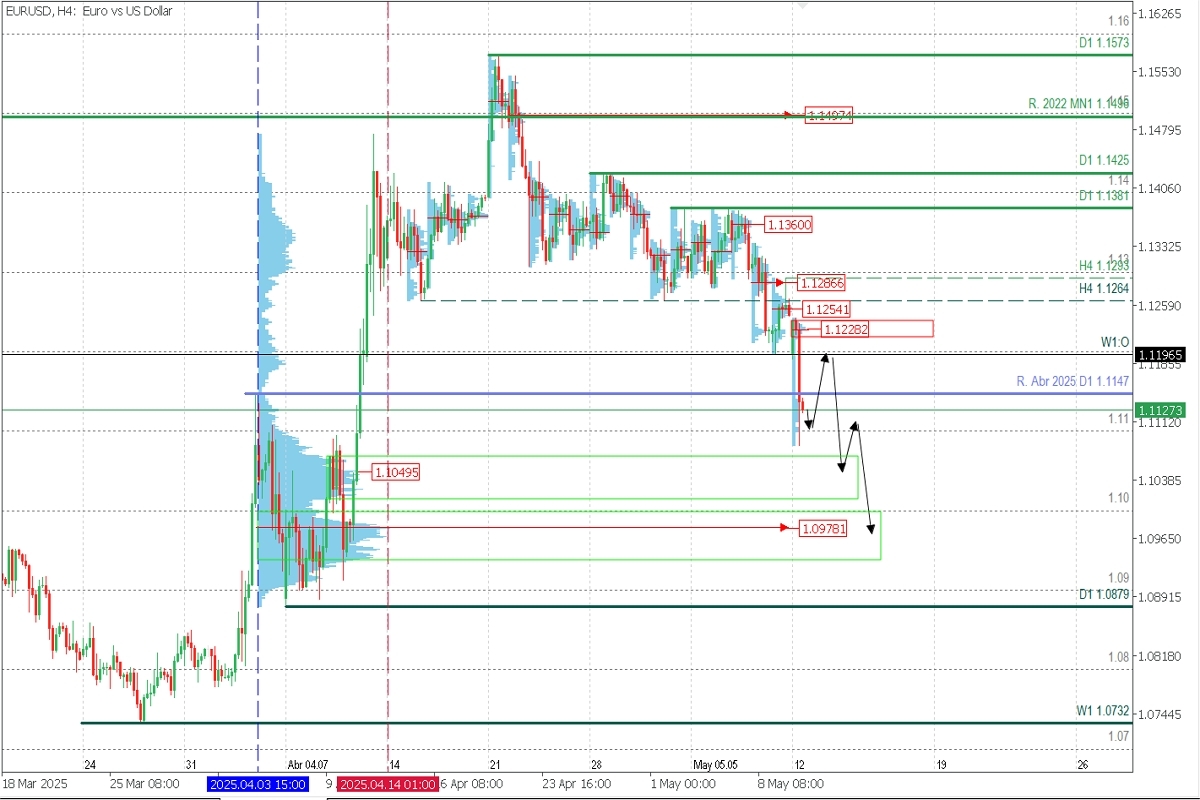

EURUSD | H4

Supply zones (Sell): 1.1228, 1.1254, 1.1286

Demand zones (Buy): 1.1095, 1.1049, 1.0978

EURUSD confirms a bearish intraday reversal, validating 1.1293 as key resistance. The downtrend remains active as long as the next retracement fails to break above that level. After hitting the psychological support at 1.11, the price is expected to retrace toward 1.12 before resuming the sell-off targeting multi-week demand areas at 1.1050 and 1.0978.

*PAR = Reversal Pattern. Always wait for confirmation on M5 near key levels. See examples 👉 Telegram Link

Uncovered POC:

POC = Point of Control: The price zone with the highest volume. If the price previously dropped from this zone, it's considered a sell area. If it rallied, it's a support area.