Fundamental Analysis

As of May 29, 2025, the U.S. Securities and Exchange Commission (SEC) has not yet issued a final decision on the XRP ETF applications submitted by Grayscale and Canary Capital. Although a resolution was expected by May 21, the SEC extended its review period, setting new deadlines: May 21 for Grayscale and May 22 for Canary. This extension remains within the maximum 240-day evaluation window permitted under Section 19(b)(2) of the Securities Exchange Act.

The entry of Franklin Templeton into the XRP ETF race has injected fresh optimism into the market. The firm filed an S-1 application with the SEC to launch the Franklin XRP Trust, which would trade on the Cboe BZX Exchange and use Coinbase Custody for holding XRP. This move has raised the odds of XRP ETF approval to 81%, according to Polymarket data. Furthermore, speculation about a potential leadership change at the SEC—replacing Chair Gary Gensler with Paul Atkins under a possible Trump administration—is fueling hopes for a more crypto-friendly regulatory environment.

Technical Analysis

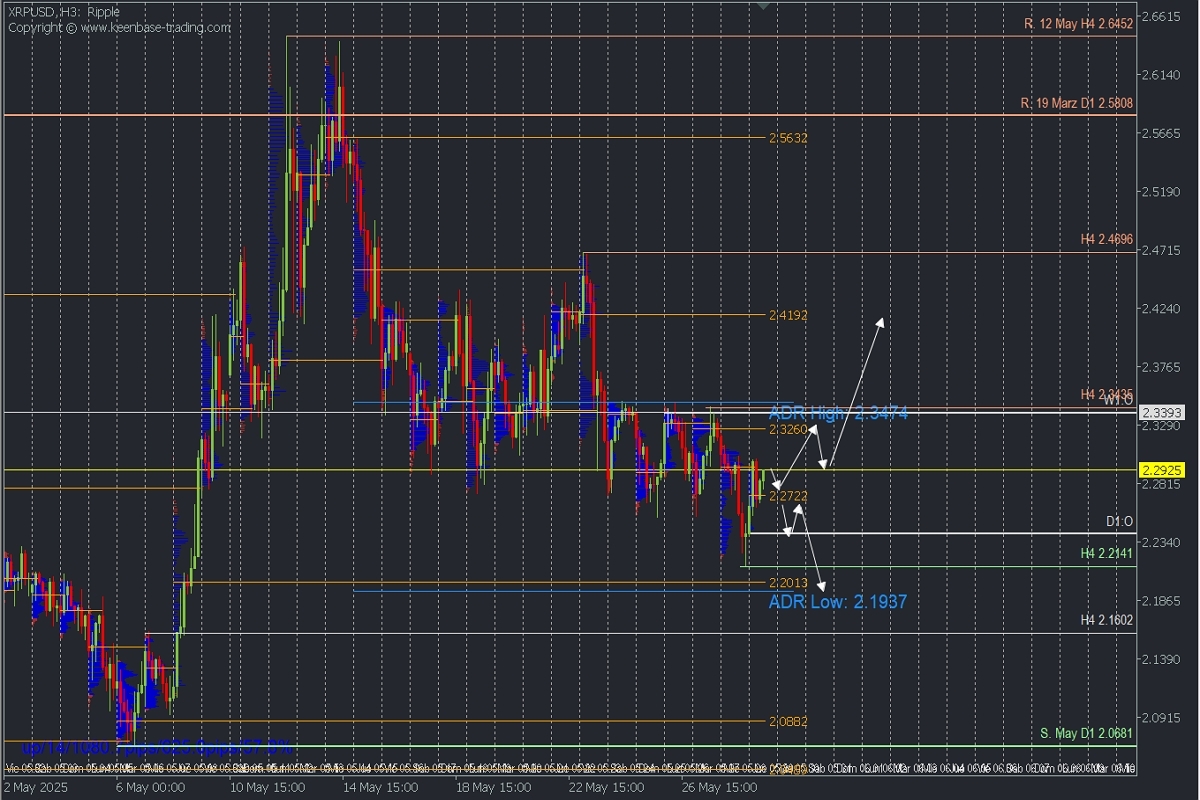

XRPUSD | H3 Supply Zones

Supply Zones (Sell): 2.3260 | 2.4192

Demand Zones (Buy): 2.2722 | 2.2013

Price Action:

The pair remains in a macro bearish correction reflected in an intraday downtrend. The last validated resistance is at 2.3435, a supply area where the daily ADR High and a previously uncovered Point of Control (POC) at 2.3260 converge.

If the pair holds below this zone, especially under the broken supply POC at 2.2953, further selling could target the initial session's POC at 2.2722. A break below this could extend the decline to support at 2.2141 and possibly to the demand area between 2.20 and 2.19.

However, with the price above the volume concentration at 2.2722, a price rebound toward the intraday confluence supply zone is possible. A breakout above this level would signal a bullish recovery with a potential move to 2.4192 in upcoming sessions.

Technical Summary:

Bullish Scenario:

Price will rise above 2.2722, targeting 2.3260 and 2.34 intraday. A breakout could expand targets to 2.41.

Bearish Scenario:

Intraday shorts are preferred below 2.26, with targets set at 2.24, 2.2141, and 2.20.

Note on POC (Point of Control):

The POC is the level where the highest volume was traded. If price previously dropped from this area, it is treated as a resistance/supply zone. If price rose, it is seen as support/demand. Always confirm entries with a Reversal/Exhaustion Pattern (PAR) on the M5 chart.

Learn more about how to confirm PAR setups in this telegram post: